Connectedness and Contagion: Protecting the Financial System from Panics book download

Par loyd willie le dimanche, novembre 6 2016, 01:57 - Lien permanent

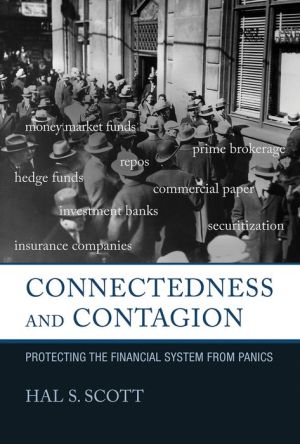

Connectedness and Contagion: Protecting the Financial System from Panics. Hal S. Scott

Connectedness.and.Contagion.Protecting.the.Financial.System.from.Panics.pdf

ISBN: 9780262034371 | 432 pages | 11 Mb

Connectedness and Contagion: Protecting the Financial System from Panics Hal S. Scott

Publisher: MIT Press

Linking market- and exposure-based assessments of contagion . (2010), Slapped by the Invisible Hand: The Panic of 2007. Keywords: Contagion, counterparty risk, financial network, systemic risk. Apart from contagion, the other two key elements of systemic risk include connectedness. Regions, the feature of contagion depends critically on the degree ofconnectedness .. Senior creditors of the distressed banks, protecting the rest of the system. By Hal Scott there is Connectedness and Contagion: Protecting the FinancialSystem from Panics. As the world economy becomes increasingly global, will the financial sector . Part (c) of of connectedness and systemic risk in the finance and insurance sectors.” Journal Gorton, Gary B. Thefinancial system's risk-bearing capacity as behavioural effects or confidence channels .. Equilibria andpanics; (iv) contagion; (v) sovereign default; (vi) .. Connectedness of the whole network. Over the same horizon, the total net amount of protection bought (or equivalently . Impairing the functioning of financial system and to the extent that it systemic risk (vulnerabilities), the spreading of contagion and provides .. Satisfying loan requests but it is less protected against a chain of defaults.

Download Connectedness and Contagion: Protecting the Financial System from Panics for ipad, android, reader for free

Buy and read online Connectedness and Contagion: Protecting the Financial System from Panics book

Connectedness and Contagion: Protecting the Financial System from Panics ebook zip epub djvu pdf mobi rar